Bankruptcy Attorney Tulsa: How Personal Bankruptcy Affects Your Assets

Bankruptcy Attorney Tulsa: How Personal Bankruptcy Affects Your Assets

Blog Article

Tulsa Bankruptcy Lawyer: Ensuring Your Case Is Handled Properly

Table of ContentsTulsa Bankruptcy Lawyer: Tips For Recovering From Personal BankruptcyThe Importance Of Bankruptcy Education: Insights From Tulsa Bankruptcy AttorneysThe Importance Of Bankruptcy Education: Insights From Tulsa Bankruptcy AttorneysTulsa Bankruptcy Lawyer: The Role Of Government Agencies In Bankruptcy Cases

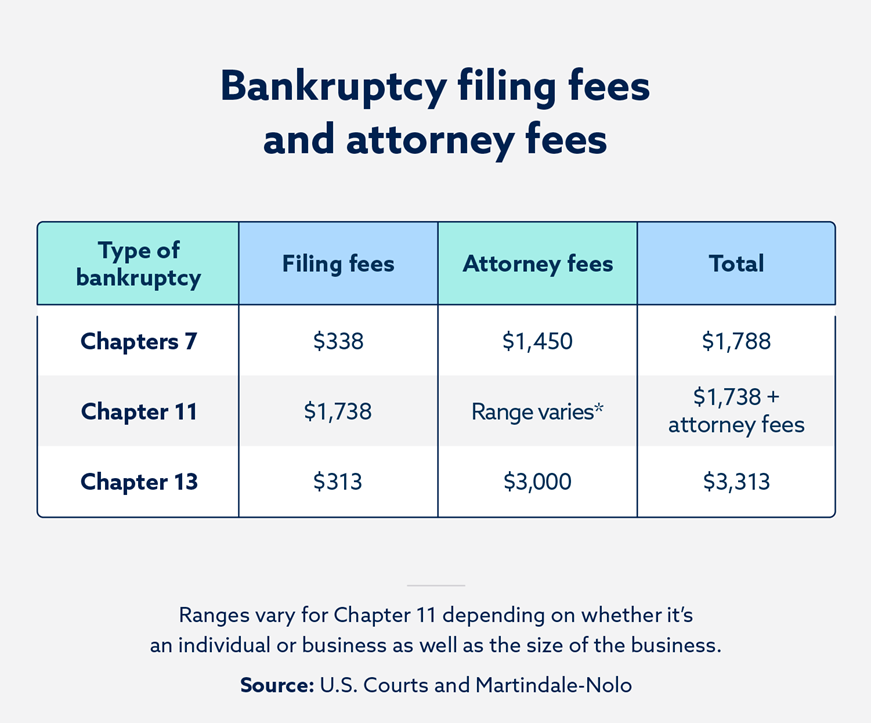

It can damage your credit report for anywhere from 7-10 years and be a barrier toward getting protection clearances. Nevertheless, if you can not fix your troubles in less than 5 years, insolvency is a viable choice. Attorney costs for bankruptcy vary relying on which create you pick, how intricate your situation is and where you are geographically. Tulsa bankruptcy lawyer.Other bankruptcy costs include a declaring fee ($338 for Phase 7; $313 for Phase 13); as well as costs for credit scores counseling and also financial administration training courses, which both cost from $10 to $100.

You do not always require an attorney when submitting individual personal bankruptcy by yourself or "pro se," the term for representing yourself. If the instance is simple enough, you can apply for bankruptcy without help. Most people profit from representation. This article clarifies: when Phase 7 is too complicated to handle yourself why hiring a Phase 13 legal representative is always vital, as well as if you represent on your own, exactly how a personal bankruptcy application preparer can help.

The general regulation is the simpler your bankruptcy, the much better your possibilities are of completing it on your very own and also receiving a bankruptcy discharge, the order eliminating financial debt. Your instance is likely straightforward sufficient to deal with without an attorney if: Nevertheless, even simple Phase 7 cases call for job. Intend on filling in extensive documentation, collecting financial paperwork, researching insolvency and exception laws, as well as complying with neighborhood guidelines and treatments.

Tulsa Bankruptcy Lawyer: The Impact Of Bankruptcy On Your Retirement Savings

Right here are 2 scenarios that constantly call for representation., you'll likely want an attorney.

Filers do not have an automatic right to dismiss a Chapter 7 situation. If you slip up, the bankruptcy court might toss out your situation or market properties you assumed you can maintain. You could also encounter a insolvency legal action to identify whether a financial obligation shouldn't be released. If you lose, you'll be stuck paying the debt after insolvency.

Filers do not have an automatic right to dismiss a Chapter 7 situation. If you slip up, the bankruptcy court might toss out your situation or market properties you assumed you can maintain. You could also encounter a insolvency legal action to identify whether a financial obligation shouldn't be released. If you lose, you'll be stuck paying the debt after insolvency. You could wish to file Phase 13 to capture up on home loan arrears so you can keep your home. Or you may want to remove your bank loan, "cram down" or decrease a cars and truck lending, or pay back a financial obligation that will not vanish in personal bankruptcy in time, such as back tax obligations or support debts.

You could wish to file Phase 13 to capture up on home loan arrears so you can keep your home. Or you may want to remove your bank loan, "cram down" or decrease a cars and truck lending, or pay back a financial obligation that will not vanish in personal bankruptcy in time, such as back tax obligations or support debts.In numerous cases, a bankruptcy attorney can rapidly identify issues you might not detect. Some individuals data for insolvency because they don't comprehend their alternatives.

Tulsa, Ok Bankruptcy Attorney: How To Deal With Medical Debt In Bankruptcy

For a lot of customers, the sensible selections are Phase 7 and also Chapter 13 personal bankruptcy. Each kind has particular benefits that resolve certain troubles. If you desire to conserve your house from repossession, Phase 13 may be your finest wager. Chapter 7 can be the means to go if you have reduced income as well as no properties.

Avoiding documentation risks can be bothersome even if you select the appropriate phase. Right here are usual problems insolvency lawyers can stop. Bankruptcy is form-driven. You'll have to finish a lengthy government packet, as well as, in some instances, your court will likewise have neighborhood forms. Lots of self-represented bankruptcy debtors don't submit every one of the required bankruptcy papers, and also their instance obtains disregarded.

You don't shed everything in bankruptcy, yet maintaining property depends on recognizing just how property exceptions work. If you stand to lose important residential property like your house, auto, or various other residential or commercial property you care about, a lawyer could be well worth the money. In Phases 7 as well as 13, insolvency filers should receive credit therapy from an accepted provider prior to filing for insolvency and finish a economic administration program prior to the court provides a discharge.

Not all insolvency cases proceed efficiently, and other, extra complicated issues can develop. Numerous self-represented Tulsa OK bankruptcy attorney filers: do not visit their website comprehend the significance of movements as well as enemy actions can't properly safeguard against an action seeking to deny discharge, as well as have a difficult time complying with confusing insolvency procedures.

Tulsa, Ok Bankruptcy Attorney: Strategies For Keeping Your Vehicle In Bankruptcy

Or another thing may appear. The lower line is that a lawyer is important when you locate on your own on the getting end of a motion or suit. If you make a decision to declare insolvency by yourself, figure out what solutions are readily available in your area for pro se filers.

, from pamphlets defining inexpensive or complimentary services to comprehensive details about personal bankruptcy. Look for a bankruptcy book that highlights scenarios needing an attorney.

You need to properly fill out many kinds, research the law, and go to hearings. If you comprehend personal bankruptcy legislation yet would certainly like help completing the types (the average bankruptcy request is around 50 web pages long), you may take into consideration hiring an insolvency request preparer. A personal bankruptcy application preparer is any kind of person or service, besides an attorney or somebody who helps an attorney, that bills a fee to prepare bankruptcy documents.

Because insolvency request preparers are not attorneys, they can not supply legal recommendations or represent you in insolvency court. Especially, they can not: tell you which kind of personal bankruptcy to submit tell you not to list particular financial debts tell you not to list particular possessions, or tell you what home to excluded.

Because insolvency request preparers are not attorneys, they can not supply legal recommendations or represent you in insolvency court. Especially, they can not: tell you which kind of personal bankruptcy to submit tell you not to list particular financial debts tell you not to list particular possessions, or tell you what home to excluded.Report this page